In "Reminiscences of a Stock Operator," the author Jesse Livermore once said something to this effect:

After making and losing millions of dollars on Wall Street, I realized that my correct market predictions did not make me a lot of money. What made me a lot of money was persistence. It's not surprising to be right about the market; many people start by going long in a bull market and short in a bear market. But many people, including me and those around me, buy and sell at the exact prices where the largest profits are made. So, being right did not make us a lot of money. Only those who are right and persist in trading can make a lot of money.

American trading giant Charlie Dennis earns 95% of his profits from 5% of his trading times each year! And these 5% of trading times in currency pair trading is the art of waiting. The reason why 95% of trading times cannot make a lot of profits or even lose money is the panic of losing money, which makes people violate principles, specifically manifested in frequent stop-loss cutting and frequent trading.

Long-term and short-term, artists and engineers

If short-term traders are artists, then long-term traders are engineers. Because artists are full of excitement and passion in their artistic creation, while engineers need long-term efforts to build projects, unexpected situations will occur in the process, and the process is full of hardships and challenges.

Long-term traders chase trends, they do not pay attention to the intraday fluctuations of prices, nor do they care how the market will go the next day, only focusing on whether the trend is about to end.

The patience of long-term traders in holding positions is not something that ordinary investors can understand or bear. There is a misunderstanding in the market that long-term traders can hold positions for a long time because they can predict the trend and end point of the market, so they are confident in holding for a long time. In fact, it is not the case. Long-term traders also do not know the future trend of the market, they just follow the trend in compliance with discipline.

Like long-term traders, holding positions in compliance with discipline requires enduring four kinds of pain:

Pain 1: The market's large fluctuations can easily eat up most of the profits of the original position;Translate the following passage into English:

Pain 2: One must give up many assured profit opportunities in exchange for long-term profits;

Pain 3: There are fewer opportunities for long-term trading, and the market spends most of the year fluctuating. During these fluctuations, long-term traders sometimes suffer continuous losses, and often it's the case that they switch from holding a profitable position to a loss, which is a great torment;

Pain 4: The most important thing in long-term trading is to maintain objectivity and discipline, and in many cases, one must give up their own vivid thoughts and judgments.

These four pains are unbearable for many people. It can be said that long-term profits are the result of a long and torturous market experience. Therefore, although long-term trading is theoretically more suitable for the majority of investors because it emphasizes rationality and objectivity, it deprives users of the joy of daily trading and forms a kind of lonely and restrained trading behavior, somewhat like an ascetic monk. This austerity causes many people to rejoin the ranks of short-term trading.

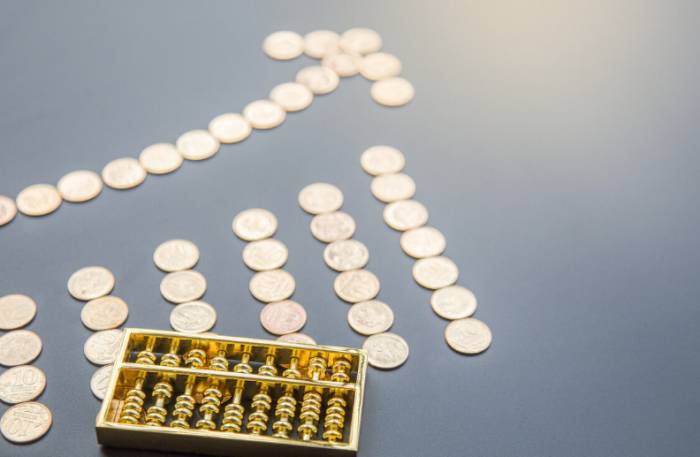

The process of long-term trading is roughly as follows: slowly buy low-priced trading varieties first, then patiently wait, and then sell at a high price later; buy low-priced trading products again, and so on in a cycle. Its biggest characteristic is to lose small and win big, not to focus on the ratio of wins and losses, but to pay attention to the quality of the wins and losses, which is also the most essential difference between it and short-term trading.

Should you choose long-term or short-term trading? This choice should not be difficult. If you want to make a lot of money in the market, you need to learn how to hold positions, because the ability to hold positions affects your ability to make a lot of money in trading.

Related Articles

In the financial market, more than 90% of traders are making meaningless trades!

The market is constantly filled with numerous investors engaging in transactions. However, some market analysts claim th...

Overconfidence destroys a Wall Street trading myth

Investing is a game of probabilities, where investors need to bet between risk and opportunity. From an investor's persp...

My Girlfriend And My Dog Were In The Same Room - What Happened Still Haunts Me To This Day-2

Trading cross-variety, the things you must know!

Cross-currency pairs, also known as cross rates, can be summarized in one sentence as currency pairs that do not include...

Trading quirk! Why does the brain hinder your trading

Do you know a lot of trading theories but still can't make a profit? Perhaps it's because we don't understand ourselves ...

My Girlfriend And My Dog Were In The Same Room - What Happened Still Haunts Me To This Day-10

What’s the Shortest Height a Human Can Be? This Top 10 Has the Jaw-Dropping Answer

No matter whether you are a novice or an expert, one of these 5 effective tradin

Every trader who achieves stable profits has a set of strategies that he or she follows. Never believe those who say the...

Grasping the time frame is the foundation of profit

The concept of a time frame refers to a specific period of time, during which the price action is displayed on a chart. ...

10 Shocking Historical Facts That Will Blow Your Mind—Each Darker Than the Last!

Dialogue with experts; how to get through the trading bottleneck?

Graduated from Shandong University with a major in Computer Science, 6 years of full-time trading, 8 years of part-time ...

Do these to become a "jungle hunter" in the trading market!

The "Adaptive Markets Hypothesis" posits that markets function much like an ecosystem, evolving gradually in a manner ak...

My Girlfriend And My Dog Were In The Same Room - What Happened Still Haunts Me To This Day-13

The "inner world" determines your trading achievements

For traders, the world can be divided into two: one is the objectively existing external world, which is the market envi...

My Girlfriend And My Dog Were In The Same Room - What Happened Still Haunts Me To This Day-11

At a loss when encountering a black swan event? The key is to do these points we

In 2020, after the COVID-19 pandemic, this super "black swan" event, the financial market also frequently witnessed blac...

These 5 methods can help you catch the best time to close positions

In the trading market, as the saying goes, the one who knows how to buy is an apprentice, and the one who knows how to s...

The investment treasure of trading "weak"

Wahaha originated from grassroots sales, achieving a 370-fold increase in 9 years during the retail period, and was late...

Edward Thorp: From casinos to financial markets, a true investment god!

Edward Thorp is a renowned pioneer of market-neutral strategies in the United States and the first person to defeat casi...

How to quickly recover after blowing up?

No trader wants to consider the issue of a margin call, yet it is almost a problem that every trader will encounter. If ...

Goddess Festival talks about the goddess: The seven most awesome goddess traders

The growth of online trading platforms has opened the door to gender equality and gradually eliminated the traditional s...

A few points to teach you how to choose the most suitable trading platform

The first step in entering the money market for investment is to choose a good trading platform. However, selecting the ...

Great speculator Jesse's 7 investment principles, revealing the truth behind his

Both his followers and fiercest rivals have to admit that as the biggest myth on Wall Street in the 20th century, Jesse ...

What are the risks, opportunities, and strategies of short-term trading? All in

In real-world trading, those who engage in short-term trades often make profits, yet they lose money in a way that is in...

My Girlfriend And My Dog Were In The Same Room - What Happened Still Haunts Me To This Day-9

Pearls of wisdom! The most comprehensive compilation of the world's top traders'

In the initial years of trading, novice traders should regard themselves as apprentices, either to a mentor, a book, or ...

What to do when trading encounters consecutive losses?

Biography of a Stock Market Master"King Cobra": Graduated from Fudan University in 2011 with a master's degree in econom...

My Girlfriend And My Dog Were In The Same Room - What Happened Still Haunts Me To This Day-4

The best retail investor in Japan, from 3 million yen to 23 billion! The trading

The real trading master to be introduced today is Japan's most outstanding individual investor. He is a mysterious figur...